A factor most buyers never consider when buying a new car is the residual value of their impending purchase. If you’re planning to keep the vehicle for years to come, it’s not really an issue. But for anyone thinking about short-term ownership, residual value can play a big role in which model they drive off the lot with. Vehicles like the Toyota Tacoma and Jeep Wrangler tend to fare well in release value year after year.

According to iSeeCars, the average vehicle is worth 49.1-percent less after five years of ownership than it was new. Trucks depreciate a little less, at 44.1%. But worst of all are electric vehicles, which on average lose 55.8% of their value in the first three years of ownership. However, the Tesla models seem to index slightly the industry average with iSeeCars reporting the company’s cars lose 48.6% of their original value after five years of ownership.

READ: How much is a Tesla Model 3?

With a Model 3 Standard Range Plus parked in my garage, I wanted to see how this stacked up against my personal experience. With a year of ownership, now makes for the perfect time to plot the first point on my graph. When purchased new, the MSRP on my 2019 Model 3 SR+ was $42,790 (including white interior, 19-inch wheels and destination). Considering the $1,875 federal tax incentive available at the time, the all-in “value” of my vehicle was $40,915. So, a year later and 30,000 miles of commuting and weekend trips (I love driving an EV so much, I’ve essentially parked my other vehicle), what’s the electric sedan worth? It’s complicated but hang with me.

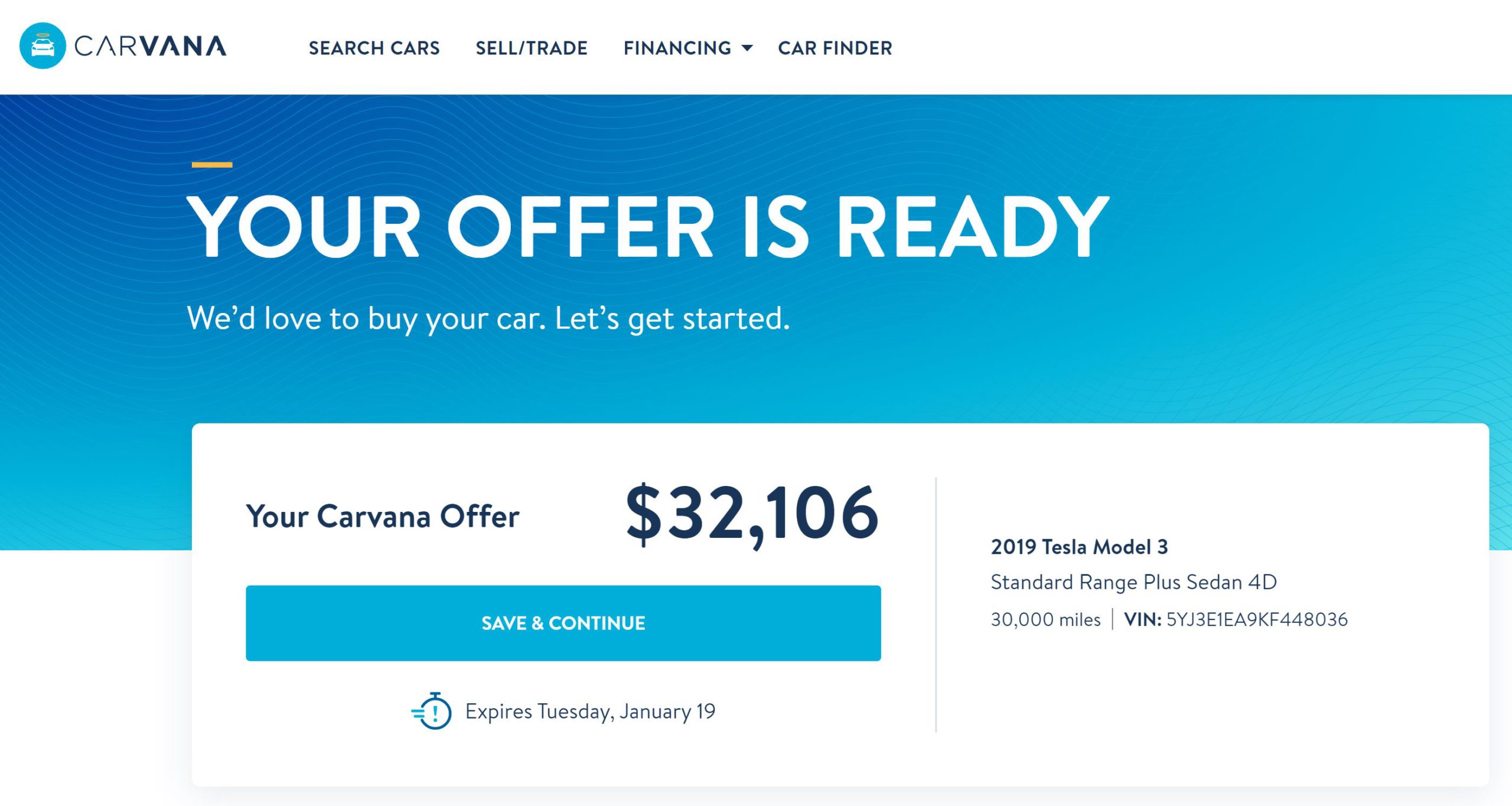

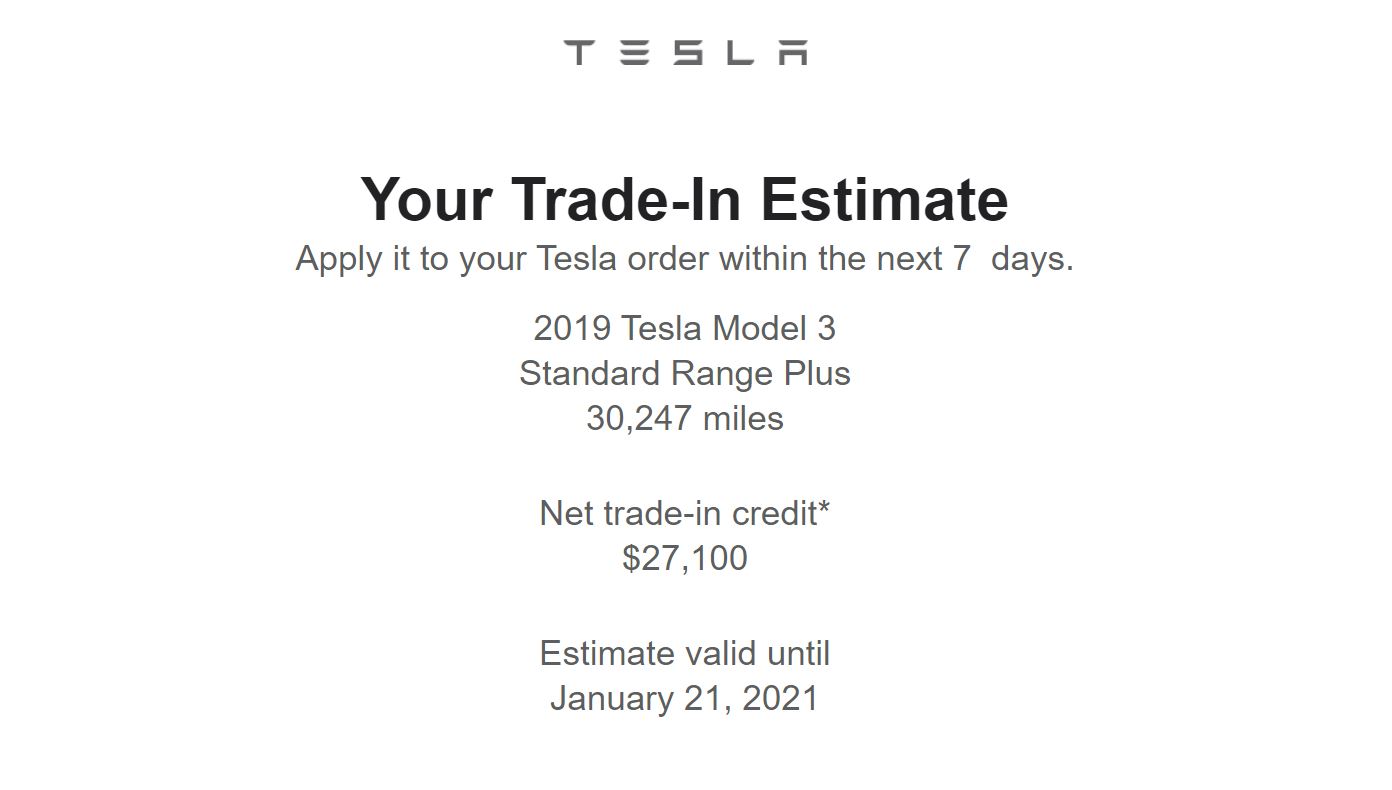

Like any large transaction, we cannot stress enough that you shop around. For this article, we used Carvana, Kelley Blue Book, Tesla and True Car for trade-in offers and private party values.

Trade-in values:

- Carvana: $32,106 (cash offer)

- Kelley Blue Book: $30,405-$33,514 (trade-in estimate)

- Tesla: $27,100 (cash offer)

- True Car: $27,375-$30,475 (trade-in estimate)

Private party value:

- Kelley Blue Book: $33,299-$36,690

The results are all over the map, ranging nearly $10,000 from Tesla’s offer to potential private-party value. I’ve had mixed results with person-to-person car transactions, but it all comes down to the level of work you mind putting in. Based on what we’re seeing, $35,000 seems like a reasonable asking price for my car in the Midwest where I reside. Carvana’s offer at $32,106 would absolutely be worth considering though if I were looking to offload my car.

Taking the Carvana offer into account, the one-year residual value for my high-mile Model 3 SR+ is 21.5% less than new — not ideal, or anywhere near the iSeeCars estimate for three years of ownership.

However, my cost per mile to operate the car is approximately $. 03 for electricity and to date zero in maintenance. Looking at the cost of gas and oil changes, perspective changes. Over a year of ownership and 30,000 miles driven, I estimate I’ve saved between $1,500-$2,000 in gas and maintenance compared to a gas-powered car. Factoring in the more conservative end of that spectrum, I’ve lost closer to 18% of the car’s “value.” This equates to $610 per month, or $25 per mile.

READ: Tesla apparently values “Full Self-Driving” at exactly $0

Thankfully I’m not one to flip through vehicles too fast, but the residual value is something I do strongly keep an eye throughout vehicle ownership. Typically, the first year is the worst for residual value hit with any new vehicle. We’ll keep an eye on it and plan to report back in a year.